interest tax shield calculator

Total income tax provision from income statement. McKinsey in their 2000 version recommended the following as one of the ways to calculate NOPLAT.

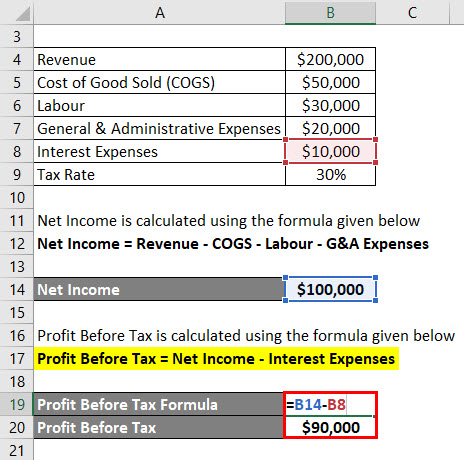

Interest Tax Shield Formula And Excel Calculator

Where taxes on EBITA.

. The formula used to calculate the adjusted present value APV consists of two components. This gives you a good idea of the tax shield on that item. The tax shield on interest is positive when earnings before interest and taxes ie EBIT exceed the interest payment.

Businesses as well as individuals may choose to utilize this type of shield as a means of choosing how to finance different purchases and projects simply to maximize the amount of. Since the additional financing benefits are taken into account the primary benefit of the APV approach is that the economic benefits stemming from financing and tax-deductible interest expense payments eg. Interest 8000 ie 2000004 Tax Shield 8000 45000 30 15900.

-Tax on non-operating income. After-tax benefit or cash inflow calculator. -Tax on interest income.

This step by step finance tool is used for calculating the interest tax shield. The bank wants 10 interest on it. So the total tax shied or tax savings available to the company will be 15900 if it purchases the asset through a financing arrangement.

When a company has debt the interest it pays on that debt that is tax-deductible creating interest tax shields that have value. The following is a basic example of how interest works. The Adjusted Present Value Calculator APV Calculator allows you to calculate the APV based on Net Present Value NPV or investment adjusted for the interest and tax advantages of leveraging debt provided that equity is the only source of financing.

The tax rate for the company is 30. Tax shield on interest expense. Adjusted Present Value Calculator APV Calculator.

Depreciation tax shield calculator. Let Our Experts Help. An interest tax shield is a term used to describe a tax break that involves deducting the interest paid on some portion of the income that is subject to taxation.

This has been a guide to Tax Shield Formula. Else this figure would be less by 2400 800030 tax rate as only depreciation would. A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest medical expenses charitable.

Future value of an annuity calculator. Net present value calculator. This interest is added to the principal and the sum becomes Dereks required repayment to the bank one year later.

The extent of tax shield varies from nation to nation and as such their benefits also vary based on the overall tax rate. The impact of adding removing a tax shield is highly impacted by the companys optimal capital structure which is a mix of debt and equity fundingMoreover the interest expense on the debt is tax deductible which makes the. About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators.

Owe 10K in Back Taxes. Schedule your Free Consultation. In the DCF analysis the ITS are baked in by including the tax-effected cost of debt in the WACC used to discount.

An investor can use Excel to build out a model to calculate the net present value of the firm and the present. Derek would like to borrow 100 usually called the principal from the bank for one year. Let the Experts Help.

The interest tax shield are broken out. 100 10 10. If you like Interest Tax Shield Calculator please consider adding a link to this tool by copypaste the following code.

Easily Project and Verify IRS and State Interest Federal Penalty Calculations. Ad Owe Over 10K in Back Tax. Interest Tax Shield Calculator.

Ad TaxInterest is the standard that helps you calculate the correct amounts. The most important financing side effect is the interest tax shield ITS. Thus interest expenses act as a shield against tax obligations.

How to calculate the tax shield. These are the tax benefits derived from the creative structuring of a financial arrangement. To calculate your tax shield first find the total cost of the deduction for the entire year then multiply that cost by your estimated tax rate.

Its 50000 debt load has an interest tax shield of 15000 or 50000. The intuition here is that the company has an 800000 reduction in taxable income since the interest expense is deductible. Simpleaccounting rate of return ARR calculator.

A Tax Shield is an allowable deduction from taxable income that results in a reduction of taxes owedTax shield can be claimed for a charitable contribution medical expenditure etc. Interest expenses via loans and mortgages are tax-deductible meaning they lower the taxable income. This companys tax savings is equivalent to the interest payment multiplied by the tax rate.

Common expenses that are deductible include depreciation amortization mortgage payments and interest expense. For individuals Tax rate is primarily used for interest expense and depreciation expense in the case of a company. This small business tool is used to derive the interest tax using the average debt tax rate and cost of debt.

Adjusted Present Value APV Formula. As such the shield is 8000000 x 10 x 35 280000. This is equivalent to the 800000 interest expense multiplied by 35.

Companies pay taxes on the income they generate. If you have 1000 in interest expense for the year with a 35 percent tax rate your tax shield would be 350. NOPLAT EBITA taxes on EBITA changes in deferred taxes.

Tax Shield A Tax Shield is an allowable deduction from taxable income that results in a reduction of taxes owed. Interest tax shields refer to the reduction in the tax liability due to the interest expenses. The value of these shields depends on the effective tax rate for the corporation or individual.

The value of the interest tax shield is the present value ie PV of all future interest tax shields. Basically the company uses two main tax shield strategies. Here we discuss how to calculate depreciation and interest tax shield for the company along with the practical examples and downloadable excel sheet.

Working In Qatar How To Calculate Your Overtime Pay 2021overtime Calculation Formula In Qatar Changing Jobs Formula Qatar

Calculez Votre Devis Banderole Actualites Du Net Referencement Efficace Sur La Longue Traine Calculator Business Man Lawyer Logo Business Cards

Taxes Icon Business Calculator Ticket Payment Taxes Commerce And Shopping Business And Finance Tax Icon Law And Justice Free Icons

Tax Shield Formula How To Calculate Tax Shield With Example

Business Finance Office Calculator In 2021 Calculator Desktop Calculator Solar Power Source

Wacc Formula Cost Of Capital Financial Management Charts And Graphs

Tax Shield Formula Step By Step Calculation With Examples

What Is A Call Option Debt Collection Agency Commercial Insurance Business Loans

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula How To Calculate Tax Shield With Example

Accounting And Finance Expert Calculate Budget Profit And Loss Produce Report Graph From Data Professional Conc In 2022 Accounting And Finance Budgeting Accounting

Interest Tax Shield Formula And Excel Calculator

Tax Shield Calculator Efinancemanagement

Calculation Icon File Document Calculator Education Report Calculation Budget Business And Finance Accounting Icon Files Icon Free Icons

Bridge Loan Meaning Features How It Works Pros And Cons Bridge Loan Money Management Advice Accounting And Finance

Tax Shield Formula Step By Step Calculation With Examples